KSeF REST API – generating invoices

KSeF REST API – generating invoices

attribute description for the operation ksefInvoiceGenerate

Operation ksefInvoiceGenerate

A method enabling the generation of an XML structured invoice compatible with the current (up-to-date) version of the schema used in National e-Invoice SystemClick on the name of the operation to go to Swagger UI.

KsefInvoiceGenerateRequest

The class represents input attributes describing the KSeF invoice

Faktura

VAT

naglowek : TNaglowek – Header of the structured invoice.

The attribute value must match Theadline.

podmiot1 : Entity1 – Taxpayer's details. The name and surname or name of the seller of goods or services.

The attribute value must match Entity1.

podmiot2 : Entity2 – Buyer's details.

The attribute value must match Entity2.

podmiot3 : Entity3 – Data of the third party(s) (other than the seller and buyer listed in the Entity2 section) related to the invoice.

The attribute value must match Entity3. (Requirement: [0..100])

podmiotUpowazniony : SubjectAuthorized – Data of the authorized entity related to the invoice.

The attribute value must match Authorized Entity. (Requirement: [0..1])

fa : Fa – Pursuant to Art. 106a – 106q of the Act. Fields regarding sales value and tax are completed in the currency in which the invoice was issued, with the exception of fields regarding tax converted in accordance with the provisions of Section VI in connection with Art. 106e section 11 of the Act. If a corrective invoice is issued, all fields are filled in as after the correction, and the fields regarding tax bases, tax and total receivables are filled in with the difference.

The attribute value must match Fa.

stopka : Footer – Invoice footer. Other details on the invoice.

The attribute value must match Footer. (Requirement: [0..1])

zalacznik : Data Block – Detailed invoice attachment data (data blocks). Maximum number of occurrences: 1000.

KsefInvoiceGenerateResponse

The class represents the response returned by the operation ksefInvoiceGenerate, which contains a generated KSeF invoice consistent with the scheme applicable in KSeF.

TextXmlContent

The class represents a KSeF Invoice or Official Confirmation of Receipt (UPO) in XML form

description : string – = Invoice or UPO.

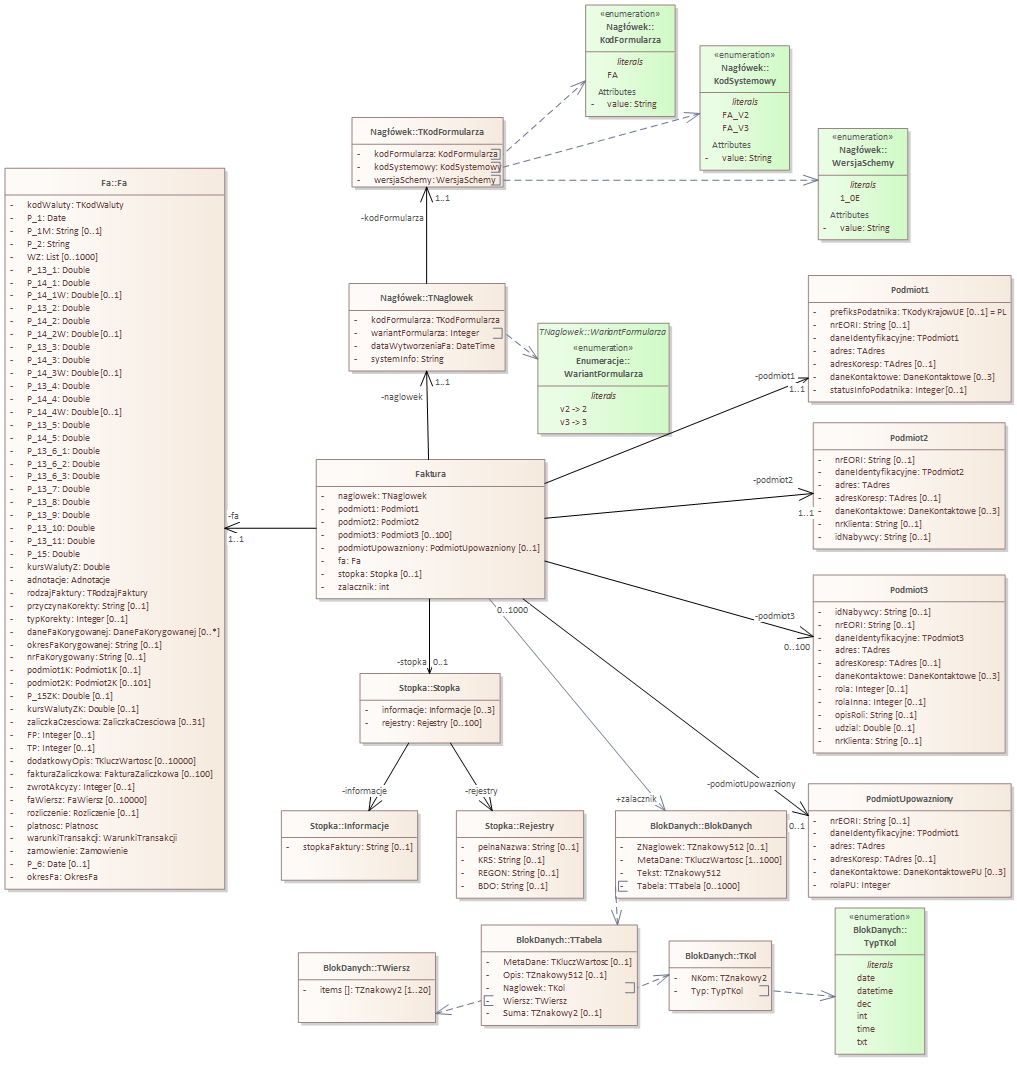

Invoice

Diagram: Invoice

KodFormularza

Form template symbol.

KodSystemowy

System code

FA_V3 : – system code

WersjaSchemy

XSD schema version.

TNaglowek

Heading

kodFormularza : TKodFormularza – Symbol of the form template. The attribute value must match TKodFormularza.

wariantFormularza : Integer – Number defining the form variant

dataWytworzeniaFa : DateTime – Date and time of invoice creation

systemInfo : String – Name of the IT system used by the taxpayer

TKodFormularza

FormCode Class

kodFormularza : KodFormularza – Code of the structured invoice form. The value must match the Enumeration FormCode.

kodSystemowy : System Code – System code of the structured invoice. The value must match the Enumeration SystemCode.

wersjaSchemy :SchemyVersion – Schema version. The value must match the Enumeration VersionSchemes.

Fa

Based on Article. 106a – 106q of the Act. Fields regarding sales value and tax are completed in the currency in which the invoice was issued, with the exception of fields regarding tax converted in accordance with the provisions of Section VI in connection with Art. 106e section 11 of the Act. If a corrective invoice is issued, all fields are filled in as after the correction, and the fields regarding tax bases, tax and total receivables are filled in with the difference.

Attention! Attributes P_13_1, P_14_1 and P_14_1W completed in the event of a sales invoice covered by the basic rate - currently 23% or 22%, excluding the margin procedure.

Attention! Attributes P_13_2, P_14_2 and P_14_2W filled in if the invoice includes a sale covered by the first reduced rate – currently 8 % or 7%, excluding the margin procedure.

Attention! Attributes P_13_3, P_14_3 and P_14_3W completed in the event of a sale covered by the second reduced rate on the invoice – currently 5%, excluding the margin procedure.

Attention! Attributes P_13_4, P_14_4 and P_14_4W filled in if the invoice includes sales covered by the third reduced rate – flat rate for passenger taxis.

Attention! Attributes P_13_5, P_14_5, P_13_6_1, P_13_6_2, P_13_6_3, P_13_7, P_13_8, P_13_9, P_13_10, P_13_11, P_15 completed in the event of a sale on the invoice under the special procedure referred to in Section XII, Chapter 6a of the Act.

kodWaluty : TKodWaluty – Three-letter currency code (ISO 4217).

The attribute value must match TKodWaluty.

P_1 : Date – Date of invoice issue, subject to Art. 106 on section 1 of the Act.

P_1M : String – Place where the invoice was issued. (Requirement: [0..1])

P_2 : String – Another invoice number, assigned within one or more series, which uniquely identifies the invoice.

WZ : List – Numbers of WZ warehouse documents (external issue) related to the invoice (duration: [0..1000])

P_13_1 : Double – Sum of net sales value with the basic rate – currently 23% or 22%. In the case of advance payment invoices, the net amount of the advance payment. In the case of corrective invoices, the amount of the difference referred to in Art. 106j section 2 point 5 of the Act.

P_14_1 : Double – Tax amount on the sum of net sales value covered by the basic rate – currently 23% or 22%. In the case of advance invoices, the tax amount calculated according to the formula referred to in Art. 106f section 1 point 3 of the Act. In the case of corrective invoices, the amount of the difference referred to in Art. 106j section 2 point 5 of the Act.

P_14_1W : Double – If the invoice is issued in a foreign currency, the amount of tax on the sum of the net sales value covered by the basic rate, converted in accordance with the provisions of Section VI in connection with Art. 106e section 11 of the Act - currently 23% or 22%. In the case of advance invoices, the tax amount calculated according to the formula referred to in Art. 106f section 1 point 3 of the Act. In the case of corrective invoices, the amount of the difference referred to in Art. 106j section 2 point 5 of the Act. (Requirement: [0..1])

P_13_2 : Double – Sum of net sales value covered by the first reduced rate – currently 8 % or 7%. In the case of advance payment invoices, the net amount of the advance payment. In the case of corrective invoices, the amount of the difference referred to in Art. 106j section 2 point 5 of the Act

P_14_2 : Double – Amount of tax on the sum of net sales value covered by the first reduced rate – currently 8% or 7%. In the case of advance invoices, the tax amount calculated according to the formula referred to in Art. 106f section 1 point 3 of the Act. In the case of corrective invoices, the amount of the difference referred to in Art. 106j section 2 point 5 of the Act.

P_14_2W : Double – If the invoice is issued in a foreign currency, the amount of tax on the sum of the net sales value covered by the reduced rate, converted in accordance with the provisions of Section VI in connection with Art. 106e section 11 of the Act - currently 8% or 7%. In the case of advance invoices, the tax amount calculated according to the formula referred to in Art. 106f section 1 point 3 of the Act. In the case of corrective invoices, the amount of the difference referred to in Art. 106j section 2 point 5 of the Act. (Requirement: [0..1])

P_13_3 : Double – Sum of net sales value covered by the second reduced rate – currently 5%. In the case of advance payment invoices, the net amount of the advance payment. In the case of corrective invoices, the amount of the difference referred to in Art. 106j section 2 point 5 of the Act.

P_14_3 : Double – Amount of tax on the sum of net sales value covered by the second reduced rate – currently 5%. In the case of advance invoices, the tax amount calculated according to the formula referred to in Art. 106f section 1 point 3 of the Act. In the case of corrective invoices, the amount of the difference referred to in Art. 106j section 2 point 5 of the Act.

P_14_3W : Double – If the invoice is issued in a foreign currency, the amount of tax on the sum of the net sales value covered by the second reduced rate, converted in accordance with the provisions of Section VI in connection with Art. 106e section 11 of the Act - currently 5%. In the case of advance invoices, the tax amount calculated according to the formula referred to in Art. 106f section 1 point 3 of the Act. In the case of corrective invoices, the amount of the difference referred to in Art. 106j section 2 point 5 of the Act. (Requirement: [0..1])

P_13_4 : Double – Sum of net sales value covered by the lump sum for passenger taxis. In the case of advance payment invoices, the net amount of the advance payment. In the case of corrective invoices, the amount of the difference referred to in Art. 106j section 2 point 5 of the Act

P_14_4 : Double – Amount of tax on the sum of net sales value in the case of a lump sum for passenger taxis. In the case of advance invoices, the tax amount calculated according to the formula referred to in Art. 106f section 1 point 3 of the Act. In the case of corrective invoices, the amount of the difference referred to in Art. 106j section 2 point 5 of the Act.

P_14_4W : Double – If the invoice is issued in a foreign currency, the lump sum tax amount for passenger taxis, converted in accordance with the provisions of Section VI in connection with Art. 106e section 11 of the Act. In the case of advance invoices, the tax amount calculated according to the formula referred to in Art. 106f section 1 point 3 of the Act. In the case of corrective invoices, the amount of the difference referred to in Art. 106j section 2 point 5 of the Act. (Requirement: [0..1])

P_13_5 : Double – The sum of the net sales value in the case of the special procedure referred to in Section XII, Chapter 6a of the Act. In the case of advance payment invoices, the net amount of the advance payment. In the case of corrective invoices, the amount of the difference referred to in Art. 106j section 2 point 5 of the Act.

P_14_5 : Double – The amount of value added tax in the case of the special procedure referred to in Section XII, Chapter 6a of the Act. In the case of advance invoices, the tax amount calculated according to the formula referred to in Art. 106f section 1 point 3 of the Act. In the case of corrective invoices, the amount of the difference referred to in Art. 106j section 2 point 5 of the Act.

P_13_6_1 : Double – Sum of sales value covered by the 0% rate, excluding intra-Community supplies of goods and exports. In the case of advance payment invoices, the amount of the advance payment. In the case of corrective invoices, the amount of the difference referred to in Art. 106j section 2 point 5 of the Act.

P_13_6_2 : Double – Sum of sales value covered by the 0% rate in the case of intra-Community supply of goods. In the case of corrective invoices, the amount of the difference referred to in Art. 106j section 2 point 5 of the Act.

P_13_6_3 : Double – Sum of sales value covered by the 0% rate in the case of export. In the case of advance payment invoices, the amount of the advance payment. In the case of corrective invoices, the amount of the difference referred to in Art. 106j section 2 point 5 of the Act.

P_13_7 : Double – Sum of tax-exempt sales value. In the case of advance payment invoices, the amount of the advance payment. In the case of correction invoices, the amount of the difference in sales value.

P_13_8 : Double – Sum of sales values in the case of delivery of goods and provision of services outside the country, excluding the amounts shown in fields P_13_5 and P_13_9. In the case of advance payment invoices, the amount of the advance payment. In the case of correction invoices, the amount of the difference in sales value.

P_13_9 : Double – The sum of the value of the provision of services referred to in Art. 100 paragraph 1 point 4 of the Act. In the case of advance payment invoices, the amount of the advance payment. In the case of correction invoices, the amount of the difference in sales value.

P_13_10 : Double – Sum of sales values under the reverse charge procedure for which the taxpayer is the buyer in accordance with Art. 17 section 1 point 7 and 8 of the Act and other reverse charge cases occurring in domestic trade. In the case of advance payment invoices, the amount of the advance payment. In the case of corrective invoices, the amount of the difference referred to in Art. 106j section 2 point 5 of the Act.

P_13_11 : Double – Sum of sales values in the margin procedure referred to in Art. 119 and art. 120 of the Act. In the case of advance payment invoices, the amount of the advance payment. In the case of correction invoices, the amount of the difference in sales value.

P_15 : Double – Total amount due. In the case of advance invoices, the payment amount is documented by the invoice. In the case of invoices referred to in Art. 106f section 3 of the Act, the amount remaining to be paid. In the case of corrective invoices, correction of the amount resulting from the corrected invoice. In the case referred to in Art. 106j section 3 of the Act, correction of amounts resulting from corrected invoices.

kursWalutyZ : Double – Exchange rate used to calculate the amount of tax in the cases referred to in the provisions of Section VI of the Act on invoices referred to in Art. 106b section 1 point 4 of the Act.

adnotacje : Annotations – Other annotations on the invoice.

The attribute value must match Annotations.

rodzajFaktury : TRodzajFaktury – Invoice type:

The attribute value must match TRodzajInvoices.

przyczynaKorekty : String – Reason for correction for correction invoices. (Requirement: [0..1])

typKorekty : Integer – Type of the effect of the correction in the records for the goods and services tax.

The attribute value must match TTypeCorrections. (Requirement: [0..1])

daneFaKorygowanej : DaneFaKorygowej – Data of the corrected invoice.

The attribute value must match DataFaCorrected. (Requirement: [0..*])

okresFaKorygowanej : String – For the corrective invoice referred to in Art. 106j section 3 of the Act - the period to which the discount or reduction granted applies, if the taxpayer grants a discount or price reduction in relation to the supply of goods or services made or provided to one recipient in a given period. (Requirement: [0..1])

nrFaKorygowany : String – Correct number of the corrected invoice if the reason for the correction is an incorrect number of the corrected invoice. In such a case, the incorrect invoice number should be indicated in the field noFaCorrected. (Requirement: [0..1])

podmiot1K : Entity1K – In case of correction of the seller's data, please provide the full details of the seller appearing on the corrected invoice. The field does not apply to the correction of an incorrect NIP (Tax Identification Number) appearing on the original invoice - then the invoice must be corrected to zero values.

The attribute value must match Entity1K. (Requirement: [0..1])

podmiot2K : Entity2K – In case of correction of data of the buyer acting as Entity2 or an additional buyer acting as Entity3, please provide full details of this entity appearing on the corrected invoice. Incorrect numbers identifying the buyer and additional buyer are not subject to correction. In the case of correcting the remaining data of the buyer or additional buyer, the indicated identification number should be identical to the number in the Entity2 or Entity3 part of the correction invoice.

The attribute value must match Entity2K. (Requirement: [0..101])

P_15ZK : Double – In the case of adjustments to advance invoices, the payment amount before the correction. In the case of invoice corrections referred to in Art. 106f section 3 of the Act, the amount remaining to be paid before the correction. (Requirement: [0..1])

kursWalutyZK : Double – Exchange rate used to calculate the tax amount in the cases referred to in Section VI of the Act before the correction. (Requirement: [0..1])

zaliczkaCzesciowa : Partial Advance – Data for cases of invoices documenting the receipt of more than one payment referred to in Art. 106b section 1 point 4 of the Act. If the invoice referred to in Art. 106f section 3 of the Act also documents the receipt of part of the payment before the action is performed, the difference in the amount in the field P_15 and sums of individual fields P_15Z is the amount remaining over and above the payments received before the activity documented by the invoice was performed.

The attribute value must match Down paymentPartial. (Requirement: [0..31])

FP : Integer – Invoice referred to in Art. 109 section 3d of the Act. (Requirement: [0..1])

TP : Integer – Existing connections between the buyer and the supplier of goods or service provider, in accordance with § 10 section 4 point 3, subject to section 4b of the regulation on the detailed scope of data included in tax returns and records in the field of tax on goods and services. (Requirement: [0..1])

dodatkowyOpis : TKluczWartosc – Fields intended for showing additional data on the invoice, including those required by law, for which no other fields/elements are provided.

The attribute value must match TKeyValue. (Requirement: [0..10000])

fakturaZaliczkowa : Advance Invoice – Numbers of advance invoices or their KSeF numbers, if they were issued using KSeF.

The attribute value must match Prepayment invoice. (Requirement: [0..100])

zwrotAkcyzy : Integer – Additional information necessary for farmers applying for a refund of excise tax included in the price of diesel oil. (Requirement: [0..1])

faWiersz : FaWiersz - Detailed invoice items in the currency in which the invoice was issued - optional node for an advance payment invoice, an invoice correcting an advance payment invoice, and correction invoices regarding all deliveries of goods or services made or provided in a given period, referred to in Art. 106j section 3 of the Act, for which data regarding the discount or reduction should be provided broken down by tax rates and procedures in part Fa. In the case of corrective invoices referred to in Art. 106j section 3 of the Act, when the discount or price reduction applies to part of the supplies of goods or services made or provided in a given period, the FaWiersz section should include the names (types) of the goods or services covered by the correction. In the case of invoices referred to in Art. 106f section 3 of the Act, the full value of the order or contract must be shown. In the case of invoices correcting invoice items (including invoices correcting invoices referred to in Article 106f(3) of the Act, if the correction concerns the value of the order), differences resulting from the correction of individual items or data of corrected items should be shown before and after the correction. correction as separate lines. In the case of corrective invoices, the invoices referred to in Art. 106f section 3 of the Act, if the correction does not concern the value of the order and at the same time changes the amount of the tax base or tax, an entry should be made as before the correction and an entry as after the correction in order to confirm that there is no change in the value of a given invoice item.

The attribute value must match FaWiersz. (Requirement: [0..10000])

rozliczenie : Settlement – Additional settlements on the invoice.

The attribute value must match Reckoning. (Requirement: [0..1])

platnosc : Payment – Payment terms.

The attribute value must match Payment.

warunkiTransakcji :TransactionConditions – Transaction conditions, if any.

The attribute value must match Transaction Terms.

zamowienie : Order – Order or agreement referred to in Art. 106f section 1 point 4 of the Act (for advance invoices) in the currency in which the advance invoice was issued. In the case of an invoice correcting an advance payment invoice, differences resulting from the correction of individual items of the order or contract or data of corrected items before and after the correction should be shown as separate lines if the correction concerns the value of the order or contract. In the case of invoices correcting advance payment invoices, if the correction does not concern the value of the order or contract and at the same time changes the amount of the tax base or tax, an entry should be made as before the correction and an entry after the correction in order to confirm that there is no change in the value of a given item.

The attribute value must match Order.

P_6 : Date – The date of completion or completion of the delivery of goods or services or the date of receipt of payment referred to in Art. 106b section 1 point 4 of the Act, provided that such a date is specified and differs from the date of issue of the invoice. The field is completed if the date is common for all invoice items. (Requirement: [0..1])

okresFa : PeriodFa – The period covered by the invoice in the cases referred to in Art. 19a section 3, first sentence and section 4 and section 5 point 4 of the Act.

The attribute value must match PeriodFa.

Podmiot1

Taxpayer details. Name and surname or name of the seller (invoice issuer) of goods or services

prefiksPodatnika : TKodyKrajowUE – Code (prefix) of the EU VAT payer for the cases specified in Art. 97 section 10 points 2 and 3 of the Act and in the case referred to in Art. 136 section 1 point 3 of the Act.

By default, this is the Polish taxpayer code, i.e. "PL". The attribute value must match TKodesNationalEU. = PL (Requirement: [0..1])

nrEORI : String – EORI number of the taxpayer (seller, invoice issuer) (Requirement: [0..1])

daneIdentyfikacyjne : TPodmotyw1 – Data identifying the taxpayer issuing the invoice. The attribute value must match TPodmiot1.

adres : TAdres – Address of the taxpayer issuing the invoice.

The attribute value must match TAddress.

adresKoresp : TAdres – Correspondence address of the taxpayer issuing the invoice. The attribute value must match TAddress. (Requirement: [0..1])

daneKontaktowe :Contact Data – A set of contact details of the taxpayer (telephone, e-mail) issuing the invoice. The attribute value must match Contact details. (Requirement: [0..3])

statusInfoPodatnika : Integer – Status of the taxpayer issuing the invoice (duration: [0..1])

Podmiot2

Buyer details

nrEORI : String – EORI number of the purchaser of goods (Requirement: [0..1])

daneIdentyfikacyjne : TPodmotyw2 – Data identifying the buyer.

The attribute value must match Entity2.

adres : TAdres – Buyer's address. Optional fields for cases specified in Art. 106e section 5 point 3 of the Act.

The attribute value must match TAddress.

adresKoresp : TAdres – The buyer's correspondence address.

The attribute value must match TAddress. (Requirement: [0..1])

daneKontaktowe :Contact Details – Contact details of the buyer.

The attribute value must match Contact details. (Requirement: [0..3])

nrKlienta : String – Customer number for cases in which the buyer uses it in the contract or order (Requirement: [0..1])

idNabywcy : String – Unique key for linking the buyer's data on correction invoices, in case the buyer's data on the correction invoice has changed in relation to the data on the corrected invoice. (Requirement: [0..1])

Podmiot3

Details of the third party(s) (other than the seller and buyer listed in the Entity2 section) related to the invoice

idNabywcy : String – Unique key for linking the buyer's data on correction invoices, in case the buyer's data on the correction invoice has changed in relation to the data on the corrected invoice. (Requirement: [0..1])

nrEORI : String – Third party EORI number (Requirement: [0..1])

daneIdentyfikacyjne : TPodmotyw3 – Data identifying the third party. The attribute value must match TPodmiot3.

adres : TAdres – Third party address. The attribute value must match TAddress.

adresKoresp : TAdres – Correspondence address of the third party. The attribute value must match TAddress. (Requirement: [0..1])

daneKontaktowe :Contact Details – Contact details of the third party. The attribute value must match Contact details. (Requirement: [0..3])

rola : Integer – Role of the entity.

The attribute value must match TRolaPodObjectu3. Required attribute unless another subject role exists (roleOther). Then this attribute he should not be completed. (Requirement: [0..1])

rolaInna : Integer – Other entity tag: 1 – Other entity. The attribute should only be populated if there is a role other than those defined for the attribute role (i.e. a role other than the one mentioned in TRolaPodObjectu3) (Requirement: [0..1])

opisRoli : String – Description of the entity's role – if the role is selected as Other entity. Attribute required only when the attribute is filled roleOther. (Requirement: [0..1])

udzial : Double – Share – percentage share of the additional buyer. The difference between the value of 100% and the sum of the shares of additional buyers is the share of the buyer listed in the Entity2 section. If the field is left blank, it is assumed that the shares of the buyers on the invoice are equal (Requirement: [0..1])

nrKlienta : String – Customer number for cases in which the entity mentioned as a third party uses it in the contract or order (Requirement: [0..1])

PodmiotUpowazniony

Details of the authorized entity related to the invoice

nrEORI : String – EORI number of the authorized entity. (Requirement: [0..1])

daneIdentyfikacyjne : TPodmotyw1 – Identification data of the authorized entity.

The attribute value must match Entity1.

adres : TAdres – Address of the authorized entity.

The attribute value must match TAddress.

adresKoresp : TAdres – Correspondence address of the authorized entity.

The attribute value must match TAddress. (Requirement: [0..1])

daneKontaktowe : DataKontaktowePU – Contact details of the authorized entity.

The attribute value must match Contact details. (Requirement: [0..3])

rolaPU : Integer – Role of the authorized entity.

The attribute value must match TRolaAuthorization Subject.

Stopka

Other details on the invoice.

informacje : Information – Other data. (Requirement: [0..3])

rejestry : Registers – Numbers of an entity or group of entities in other registers and databases. (Requirement: [0..100])

Informacje

Other data.

stopkaFaktury : String – Invoice footer. (Requirement: [0..1])

Rejestry

Numbers of the entity or group of entities in other registers and databases

pelnaNazwa : String – Full name of the entity (Requirement: [0..1])

KRS : String – National Court Register Number (Requirement: [0..1])

REGON : String – REGON number. (Requirement: [0..1])

BDO : String – Number in the Waste Database (Requirement: [0..1])

BlokDanych

Class represents attachment data.

ZNaglowek : TZnacharkowy512 – Data block header [optional field]. Specify the header of the given data block. Maximum number of characters: 512

MetaDane : TKluczWartosc – An attribute of the array type. Descriptive data for a data block. Descriptive data characterizing a given data block is provided (composed of the ZKlucz and ZWartosc composite types). Maximum number of occurrences: 1000

Tekst : TCharacter512′ – Array type attribute. Text part of the data block [optional element]. The Text element contains the text part of the data block consisting of paragraphs. Maximum number of characters: 512. Maximum number of occurrences: 10.

Tabela : Table – Array type attribute. Data table [optional element]. The Table element allows for the representation of logically organized data, which is typically presented in tabular form (e.g., regarding electricity consumption for a given energy consumption point), in an XML file. Maximum number of tables in a single data block: 1000.

TTabela

The class represents a table.

MetaDane : TKeyValue – Descriptive data about the table [optional element]. Descriptive data (metadata) characterizing the given data table (composed of the composite type TKlucz and TWartosc) is provided. Maximum number of occurrences: 1000

Opis : TZnakowy512 – Table Description [optional field]. Provide a description of the given data table. Maximum number of characters: 512.

Naglowek : TKol – Table Header. The Header element consists of cells that constitute the content of the data table header (i.e., the names of the individual data table columns and the types of data they contain).

Wiersz : T poem – Table Rows. The Row element consists of cells constituting the content of individual rows of the data table. Maximum number of rows in a single table: 1000

Suma : TZnakowy2 – Table summaries [optional element]. The Sum element summarizes the data presented in the table.

TKluczWartosc

The class thus represents a composite key-value.

NrWiersza : TNatural – Next order number.

Klucz : Character – Key for an undefined field that is part of a composite key-value type. Provide the name of the field intended for displaying data table metadata. The name is indicated by the taxpayer. Maximum number of characters: 256.

Wartosc : TCharacter – Field value that is part of a key-value composite type. Provide the field value for displaying data table metadata. The value is specified by the taxpayer. Maximum number of characters: 256.

TKol

The class represents column headers.

NKom : TCharacter2 – Cell Content. Specifies the content of the cell that is the header of a given column in the data table. Maximum number of characters: 256.

Typ : TypTKol – The data type in the table header (individual table columns). Specify:

- date – if a given data column contains data of the date type,

- datetime – if a given data column contains date and time data,

- December – if a given data column contains data of the number type with decimal places,

- int – if a given data column contains integer data,

- time – if a given data column contains time-type data,

- txt – when a given data column contains text data.

TWiersz

A class represents a table row.

items : TZnakrykowy2 – Table row cells. Specifies the content of individual cells within a given table row. Maximum number of cells in one row: 20.

Fa

Adnotacje

Other annotations on the invoice

P_16 : Integer – In the case of the supply of goods or provision of services in respect of which tax liability arises in accordance with Art. 19a section 5 point 1 or art. 21 section 1 of the Act - the words "cash method", enter the value "1"; otherwise – the value "2".

P_17 : Integer – In the case of invoices referred to in Art. 106d section 1 of the Act - the word "self-invoicing", enter the value "1"; otherwise – value "2"

P_18 : Integer - In the case of the supply of goods or provision of services for which the purchaser of the goods or services is liable for settling value added tax or a tax of a similar nature - the words "reverse charge", the value "1" should be provided, otherwise - the value " 2".

P_18A : Integer - In the case of invoices in which the total amount due exceeds PLN 15,000 or its equivalent expressed in a foreign currency, covering the supply of goods or services made to the taxpayer referred to in Annex No. 15 to the Act - the words "split split mechanism" payments", whereas the conversion of amounts expressed in foreign currencies into Polish zlotys is subject to the principles of conversion of amounts used to determine the tax base; the value "1" must be provided, otherwise - the value "2".

zwolnienie : Exemption – A set of attributes informing about possible tax exemptions.

The attribute value must match Sick leave.

noweSrodkiTransportu : NoweSrodkiTransportu – A set of attributes describing new means of transport.

The attribute value must match NewSrodkiTransportu.

P_23 : Integer – In the case of invoices issued under the simplified procedure by the second-highest taxpayer referred to in Art. 135 section 1 point 4 letter bic and mouth 2, containing the annotation referred to in Art. 136 section 1 point 1 and the statement referred to in Art. 136 section 1 point 2 of the Act, the value "1" should be provided, otherwise - the value "2".

pmarzy : PMarzy – Marker for the occurrence of margin procedures.

The attribute value must match PMars.

TRodzajFaktury

Invoice type.

ZAL : - Prepayment invoice. An invoice documenting the receipt of payment or part thereof before performing an action and an invoice issued in connection with Art. 106f section 4 of the Act.

ROZ : – Settlement invoice. Invoice issued in connection with Art. 106f section 3 of the Act.

UPR : – Simplified invoice. The invoice referred to in Art. 106e section 5 point 3 of the Act.

KOR_ZAL : – Correction of the advance payment invoice. An invoice correcting an invoice documenting the receipt of payment or part thereof before performing an action and an invoice issued in connection with Art. 106f section 4 of the Act.

KOR_ROZ : – Correction of the settlement invoice. An invoice correcting an invoice issued in connection with Art. 106f section 3 of the Act.

TTypKorekty

Type of effect of correction in the records for tax on goods and services

1 : Integer – Correction effective on the date of recognition of the original invoice.

2 : Integer – Correction effective on the date of issue of the corrective invoice.

3 : Integer – Correction resulting in a different date, including when the dates are different for different items of the corrective invoice.

DaneFaKorygowanej

Corrected invoice details.

dataWystFaKorygowanej : Date – Date of issue of the corrected invoice

nrFaKorygowanej : String – Number of the corrected invoice.

nrKSeF : Integer – Tag of the KSeF number of the corrected invoice.

nrKSeFFaKorygowanej : String – Number identifying the invoice corrected in KSeF.

Attribute value verified by regular expression:

([1-9]((\d[1-9])|([1-9]\d))\d{7}|M\d{9}|[A-Z]{3}\d{7})-(20[2-9][0-9]|2[1-9][0-9]{2}|[3-9][0-9]{3})(0[1-9]|1[0-2])(0[1-9]|[1-2][0-9]|3[0-1])-([0-9A-F]{6})-?([0-9A-F]{6})-([0-9A-F]{2})

nrKSeFN : Integer – Tag of the corrected invoice issued outside KSeF

Podmiot1K

In case of correction of the seller's data, please provide the full details of the seller appearing on the corrected invoice. The field does not apply to the correction of an incorrect NIP number appearing on the original invoice - then the invoice must be corrected to zero values.

prefiksPodatnika : TKodyKrajowUE – Code (prefix) of the EU VAT payer for the cases specified in Art. 97 section 10 points 2 and 3 of the Act and in the case referred to in Art. 136 section 1 point 3 of the Act.

daneIdentyfikacyjne : TPodmotyw1 – Taxpayer identification data.

The attribute value must match Entity1.

adres : TAdres – Taxpayer's address.

The attribute value must match TAddress.

Podmiot2K

In the event of correction of the data of the buyer acting as Entity2 or an additional buyer acting as Entity3, please provide the full details of this entity appearing on the corrected invoice. Incorrect numbers identifying the buyer and additional buyer are not subject to correction. In the case of correcting the remaining data of the buyer or additional buyer, the indicated identification number should be identical to the number in the Entity2 or Entity3 part of the correction invoice.

daneIdentyfikacyjne : TPodmotyw2 – Data identifying the buyer.

The attribute value must match Entity2.

adres : TAdres – Buyer's address. Optional fields for cases specified in Art. 106e section 5 point 3 of the Act.

The attribute value must match TAddress. (Requirement: [0..1])

idNabywcy : String – Unique key for linking the buyer's data on correction invoices, in case the buyer's data on the correction invoice has changed in relation to the data on the corrected invoice. (Requirement: [0..1])

ZaliczkaCzesciowa

Data for cases of invoices documenting the receipt of more than one payment referred to in Art. 106b section 1 point 4 of the Act. If the invoice referred to in Art. 106f section 3 of the Act also documents the receipt of part of the payment before performing the activity, the difference in the amount in field P_15 and the sum of individual fields P_15Z constitutes the amount remaining over the payments received before performing the activity documented with the invoice.

P_6Z : DateTime – Date of receipt of the payment referred to in Art. 106b section 1 point 4 of the Act.

P_15Z : Double – Payment amount referred to in Art. 106b section 1 point 4 of the Act, constituting the amount in field P_15. In the case of corrective invoices, correction of the amount resulting from the corrected invoice.

kursWalutyZW : Double – Exchange rate used to calculate the tax amount in the cases referred to in Section VI of the Act. (Requirement: [0..1])

TKluczWartosc

Complex type, key-value.

Fields intended for showing additional data on the invoice, including those required by law, for which no other fields/elements are provided

nrWiersza : Integer – Line number given in the NrWierszaFa or NrWierszaZam field, if the information refers only to a given invoice item. (Requirement: [0..1])

FakturaZaliczkowa

Advance invoice numbers or their KSeF numbers, if issued using KSeF.

The class should be populated with either attribute Advance InvoiceNo, or Advance InvoiceSeF No. Both attributes cannot occur at the same time.

fakturaZaliczkowaNr : Advance InvoiceNo. – The attribute value must match Advance Invoice No. (Requirement: [0..1])

fakturaZaliczkowaNrKSeF : InvoiceAdvanceNrKSeF – The attribute value must be consistent with Advance InvoiceSeF No. (Requirement: [0..1])

FakturaZaliczkowaNr

Advance invoice number issued outside KSeF

nrKSeFZN : Integer – Tag of an advance invoice issued outside KSeF.

nrFaZaliczkowej : String – Number of the advance invoice issued outside KSeF. Mandatory field for an invoice issued after the goods have been delivered or the service has been provided, as referred to in Art. 106f section 3 of the Act and the last of the invoices referred to in Art. 106f section 4 of the Act.

FakturaZaliczkowaNrKSeF

Advance invoice number issued via KSeF.

nrKSeFFaZaliczkowej : String – Number identifying the advance invoice in KSeF. Mandatory field if the advance invoice was issued using KSeF.

FaWiersz

Detailed invoice items in the currency in which the invoice was issued - optional node for an advance payment invoice, an invoice correcting an advance payment invoice, and correction invoices relating to all deliveries of goods or services made or provided in a given period, referred to in Art. 106j section 3 of the Act, for which data regarding the discount or reduction should be provided broken down by tax rates and procedures in part Fa. In the case of corrective invoices referred to in Art. 106j section 3 of the Act, when the discount or price reduction applies to part of the supplies of goods or services made or provided in a given period, the FaWiersz section should include the names (types) of the goods or services covered by the correction. In the case of invoices referred to in Art. 106f section 3 of the Act, the full value of the order or contract must be provided. In the case of invoices correcting invoice items (including invoices correcting invoices referred to in Article 106f(3) of the Act, if the correction concerns the value of the order), differences resulting from the correction of individual items or data of corrected items should be shown before and after the correction. correction as separate lines. In the case of corrective invoices, the invoices referred to in Art. 106f section 3 of the Act, if the correction does not concern the value of the order and at the same time changes the amount of the tax base or tax, an entry should be made as before the correction and an entry as after the correction in order to confirm that there is no change in the value of a given invoice item.

nrWierszaFa : Integer – The next number of the invoice line.

UU_ID : String – Universal unique invoice line number (Requirement: [0..1])

P_6A : Date – The date of completion or completion of the delivery of goods or services or the date of receipt of payment referred to in Art. 106b section 1 point 4 of the Act, provided that such a date is specified and differs from the date of issue of the invoice. The field is filled in when there are different dates for individual invoice items. (Requirement: [0..1])

P_7 : String – Name (type) of the product or service. Optional field only for the case specified in Article 106j section 3 point 2 of the Act (correction invoice) (due: [0..1])

indeks : String – Field intended for entering the internal code of the product or service assigned by the taxpayer or an additional description (Required: [0..1])

GTIN : String – Global trade item number. (Requirement: [0..1])

pkWiU : String – Symbol of the Polish Classification of Products and Services. (Requirement: [0..1])

CN : String – Symbol of the Combined Nomenclature. (Requirement: [0..1])

PKOB : String – Symbol of the Polish Classification of Building Objects. (Requirement: [0..1])

P_8A : String – Measure of goods delivered or scope of services provided. Optional field for the case specified in Art. 106e section 5 point 3 of the Act. (Requirement: [0..1])

P_8B : Double – Quantity (number) of goods delivered or scope of services provided. Optional field for the case specified in Art. 106e section 5 point 3 of the Act. (Requirement: [0..1])

P_9A : Double – Unit price of a good or service without the amount of tax (net unit price). Optional field for cases specified in Art. 106e section 2 and 3 and section 5 point 3 of the Act (due date: [0..1])

P_9B : Double – Price with the amount of tax (gross unit price), in the case of application of Art. 106e section 7 and 8 of the Act. (Requirement: [0..1])

P_10 : Double – Amounts of any discounts or price reductions, including in the form of a discount for early payment, unless they were included in the net unit price, and in the case of application of Art. 106e section 7 of the Act at the gross unit price. Optional field for cases specified in Art. 106e section 2 and 3 and section 5 point 1 of the Act. (Requirement: [0..1])

P_11 : Double – Value of the goods delivered or services provided, included in the transaction, without the amount of tax (net sales value). Optional field for cases specified in Art. 106e section 2 and 3 and section 5 point 3 of the Act. (Requirement: [0..1])

P_11A : Double – Gross sales value, if Art. 106e section 7 and 8 of the Act. (Requirement: [0..1])

p11Vat : Double – Tax amount in the case referred to in Art. 106e section 10 of the Act. (Requirement: [0..1])

P_12 : TStawkaPodatku – Tax rate. Optional field for cases specified in Art. 106e section 2, 3, section 4 point 3 and section 5 point 3 of the Act. (Requirement: [0..1])

P_12_XII : Double – Value added tax rate in the case referred to in Section XII, Chapter 6a of the Act. (Requirement: [0..1])

p12Zal15 : Integer – Tag for the product or service listed in Annex 15 to the Act – value "1". (Requirement: [0..1])

kwotaAkcyzy : Double – The amount of excise duty included in the price of the goods. (Requirement: [0..1])

GTU : TGTU – Designation for the supply of goods and services.

The attribute value must match TGTU. (Requirement: [0..1])

procedura : TOprocedure designation – Procedure designation.

The attribute value must match TOmeaningProcedures. (Requirement: [0..1])

kursWaluty : Double – Currency rate used to calculate the tax amount in the cases referred to in Section VI of the Act (Requirement: [0..1])

stanPrzed : Integer – Status marker before correction in the case of a correction invoice or an invoice correcting an invoice issued in connection with Art. 106f section 3 of the Act, if the correction concerns data shown in the invoice items and is made in a way that involves showing the data before and after the correction as separate lines with separate numbering and in the case of confirming the lack of change in the value of a given item (due: [0..1 ])

Rozliczenie

Additional settlements on the invoice.

The class should be populated with either attribute to pay, or for settlement. Both attributes cannot occur at the same time.

The attribute value must match Loads. (Requirement: [0..100])

sumaObciazen : Double – Sum of loads. (Requirement: [0..1])

odliczenia : Deductions – Deductions.

The attribute value must match Deductions. (Requirement: [0..100])

sumaOdliczen : Double – Sum of deductions (due: [0..1])

doZaplaty : Double – Amount due equal to the field P_15 increased by Loads and less Deductions. (Requirement: [0..1])

doRozliczenia : Double – Amount overpaid for settlement/refund. (Requirement: [0..1])

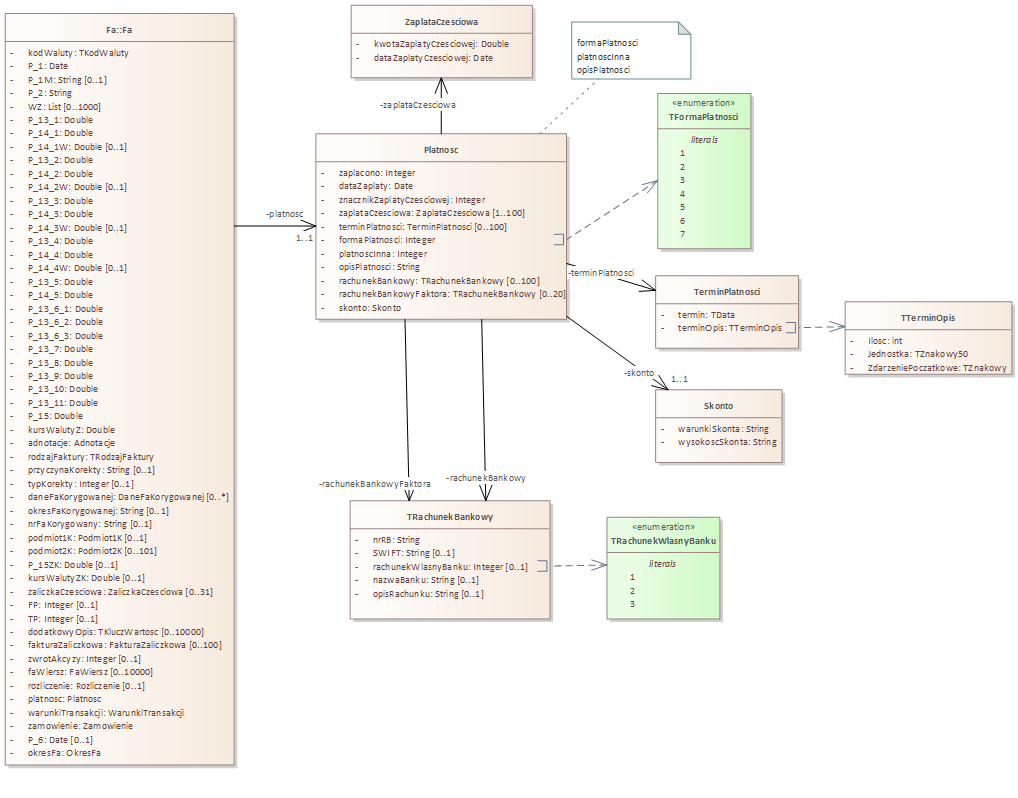

Platnosc

Terms of payment.

zaplacono : Integer – Tag informing that the amount due from the invoice has been paid: 1 – paid

dataZaplaty : Date – Payment date, if payment has been made before the invoice is issued.

znacznikZaplatyCzesciowej : Integer – Tag informing that the amount due from the invoice has been paid in part: 1 – paid in part.

zaplataCzesciowa : ZaplataCzesciowa – Details of partial payments.

The attribute value must match PaymentPartial. (Requirement: [1..100])

terminPlatnosci : PaymentTerm – Payment deadline.

The attribute value must match Date of payment. (Requirement: [0..100])

formaPlatnosci : Integer – Payment method.

The attribute value must match TFormaPlatnosci.

platnoscInna : Integer – Tag of another form of payment: 1 – other form of payment.

opisPlatnosci : String – Specifying another payment method.

rachunekBankowy : TRachunekBankowy – Bank account details.

The attribute value must match TRachunekBankowy. (Requirement: [0..100])

rachunekBankowyFaktora : TRachunekBankowy – Factor's bank account details.

The attribute value must match TRachunekBankowy. (Requirement: [0..20])

The attribute value must match Discount.

WarunkiTransakcji

Transaction terms, if any.

umowy : Contracts – Data describing the contract.

The attribute value must match Agreements. (Requirement: [0..100])

zamowienia : Orders – Data describing the order.

The attribute value must match Orders. (Requirement: [0..100])

nrPartiiTowaru : List – Goods lot numbers (Requirement: [0..1])

warunkiDostawy : String – Terms of delivery of goods – if there is an agreement between the parties to the transaction specifying the terms of delivery of the so-called Incoterms.

kursUmowny : Double – Contractual exchange rate – in cases where the invoice contains information about the exchange rate at which the amounts shown on the invoice in PLN were converted. It does not apply to the cases referred to in Section VI of the Act. (Requirement: [0..1])

walutaUmowna : TKodWaluty – Contractual currency – three-letter currency code (ISO-4217) in cases where the invoice contains information about the exchange rate at which the amounts shown on the invoice in PLN were converted. It does not apply to the cases referred to in Section VI of the Act.

The attribute value must match TKodWaluty.

transport : Transport – Data describing the transport used during delivery.

The attribute value must match Transport. (Requirement: [0..20])

podmiotPosredniczacy : Integer – The value "1" means the delivery made by the entity referred to in Art. 22 section 2d of the Act. The field concerns the case in which the entity participates in a chain transaction other than the simplified triangular procedure referred to in Art. 135 section 1 point 4 of the Act. (Requirement: [0..1])

Zamowienie

The order or agreement referred to in Art. 106f section 1 point 4 of the Act (for advance invoices) in the currency in which the advance invoice was issued. In the case of an invoice correcting an advance payment invoice, differences resulting from the correction of individual items of the order or contract or data of corrected items before and after the correction should be shown as separate lines if the correction concerns the value of the order or contract. In the case of invoices correcting advance payment invoices, if the correction does not concern the value of the order or contract and at the same time changes the amount of the tax base or tax, an entry should be made as before the correction and an entry after the correction in order to confirm that there is no change in the value of a given item.

wartoscZamowienia : Double – Value of the order or contract including the amount of tax.

zamowienieWiersz : OrderWiersz – Detailed items of the order or contract in the currency in which the advance payment invoice was issued.

The attribute value must match OrderPoem. = new ArrayList<>() (Requirement: [1..10000])

OkresFa

The period covered by the invoice in the cases referred to in Art. 19a section 3, first sentence and section 4 and section 5 point 4 of the Act.

p6Od : java.time.LocalDate – Starting date of the period to which the invoice applies.

p6Do : java.time.LocalDate – End date of the period covered by the invoice – date of completion or completion of the delivery of goods or provision of the service.

Annotations

Adnotacje

Class description Annotations.

NoweSrodkiTransportu

The class should be populated with either the z attribute NewMeans of TransportNone, or attributes from NewSrodkiTransportuTyp. Both attributes cannot occur at the same time.

noweSrodkiTransportuBrak : NoweSrodkiTransportuLak – No new means of transport in the delivery.

The attribute value must match NewMeans of TransportNone. (Requirement: [0..1])

noweSrodkiTransportuTyp : NoweSrodkiTransportuTyp – Type of the new means of transport in the delivery.

The attribute value must match NewSrodkiTransportuTyp. (Requirement: [0..1])

NoweSrodkiTransportuBrak

The class informs about the lack of a new means of transport in the delivery.

P_22N : Integer – Marker of the lack of intra-Community supply of new means of transport.

NewSrodkiTransportuTyp

The class informs about the type of new means of transport in the delivery.

P_22 : Integer – Tag for intra-Community delivery of new means of transport.

P_42_5 : Integer – If there is an obligation referred to in Art. 42 section 5 of the Act, the value "1" should be provided, otherwise - the value "2".

nowySrodekTransportu : NowySrodekTransportu – Attribute describing the new means of transport.

The attribute value must match NewSrodekTransportu. (Requirement: [1..10000])

NowySrodekTransportu

The class describes a new means of transportation.

P_22A : Date – Date when the new means of transport was approved for use.

pNrWierszaNST : Integer – Invoice line number showing the delivery of a new means of transport.

P_22BMK : String – Brand of the new means of transport (Requirement: [0..1])

P_22BMD : String – Model of a new means of transport. (Requirement: [0..1])

P_22BK : String – Color of the new means of transport (Requirement: [0..1])

P_22BNR : String – Registration number of the new means of transport. (Requirement: [0..1])

P_22BRP : String – Year of production of the new means of transport. (Requirement: [0..1])

P_22B : String – If the delivery concerns land vehicles referred to in Art. 2 point 10 letter a of the Act - the mileage of the vehicle must be provided.

P_22B1 : String – If the delivery concerns land vehicles referred to in Art. 2 point 10 letter and the Act - you can provide the VIN number. (Requirement: [0..1])

P_22B2 : String – If the delivery concerns land vehicles referred to in Art. 2 point 10 letter a of the Act - you can provide the chassis number (Requirement: [0..1])

P_22B3 : String – If the delivery concerns land vehicles referred to in Art. 2 point 10 letter a of the Act – you can provide the chassis number (Requirement: [0..1])

P_22B4 : String – If the delivery concerns land vehicles referred to in Art. 2 point 10 letter and the act – you can provide the frame number. (Requirement: [0..1])

P_22BT : String – If the delivery concerns land vehicles referred to in Art. 2 point 10 letter a of the Act - you can provide the type of new means of transport (Requirement: [0..1])

P_22C : String – If the delivery concerns vessels referred to in Art. 2 point 10 letter b of the Act, the number of working hours of using the new means of transport should be provided.

P_22C1 : String – If the delivery concerns vessels referred to in Art. 2 point 10 letter b of the Act, the hull number of the new means of transport may be provided. (Requirement: [0..1])

P_22D : String – If the delivery concerns aircraft referred to in Art. 2 point 10 letter c of the Act, the number of working hours of using the new means of transport should be provided.

P_22D1 : String – If the delivery concerns aircraft referred to in Art. 2 point 10 letter c of the Act, you can provide the factory number of the new means of transport.

PMarzy

A class that describes the margin procedure.

P_PMarzy : Integer – Marker for the occurrence of margin procedures referred to in Art. 119 or art. 120 of the Act.

P_PMarzy_2 : Integer – Marker for the provision of tourism services for which the tax base is the margin, in accordance with Art. 119 section 1 of the Act, and the invoice documenting the service contains the words "margin procedure for travel agencies"

P_PMarzy_3_1 : Integer – Marker of the delivery of used goods for which the tax base is the margin, in accordance with Art. 120 of the Act, and the invoice documenting the delivery contains the words "margin procedure - used goods".

P_PMarzy_3_2 : Integer – Tag for the delivery of works of art for which the tax base is the margin, in accordance with Art. 120 of the Act, and the invoice documenting the delivery contains the words "margin procedure - works of art"

P_PMarzy_3_3 : Integer – Delivery tag for collectors' items and antiques for which the tax base is a margin, in accordance with Art. 120 of the Act, and the invoice documenting the delivery contains the words "margin procedure - collectors' items and antiques".

P_PMarzyN : Integer – Marker of the absence of margin procedures referred to in Art. 119 or art. 120 of the Act.

Zwolnienie

The class should be populated with either the z attribute ExemptionNone, or attributes from ReleaseType. Both attributes cannot occur at the same time.

zwolnienieBrak : ExemptionNone – Attribute filled in if there is no tax exemption.

The attribute value must match ExemptionNone. (Requirement: [0..1])

zwolnienieTyp : ExemptionType – Attribute filled in in case of tax exemption.

The attribute value must match ReleaseType. (Requirement: [0..1])

ZwolnienieBrak

No tax exemption.

P_19N : Integer – Marker of the lack of delivery of goods or provision of services exempt from tax under Art. 43 section 1, art. 113 section 1 and 9 of the Act or regulations issued pursuant to Art. 82 section 3 of the Act or pursuant to other provisions.

ZwolnienieTyp

Tax exemption

P_19 : Integer – Tag for the supply of goods or services exempt from tax under Art. 43 section 1, art. 113 section 1 and 9 or regulations issued pursuant to Art. 82 section 3 of the Act or pursuant to other provisions.

P_19A : String – If field P_19 equals "1" - indicate the provision of the act or the act issued pursuant to the act on the basis of which the taxpayer applies tax exemption.

P_19B : String – If field P_19 equals "1" - indicate the provision of Directive 2006/112/EC that exempts such a supply of goods or provision of services from tax.

P_19C : String – If field P_19 equals "1" - please indicate another legal basis indicating that the supply of goods or provision of services is tax exempt.

FaWiersz

Diagram: FaWiersz

TGTU

Indication relating to the supply of goods and services.

value : String

GTU_01 : – Delivery of goods referred to in § 10 section 3 point 1 letter a of the regulation on the detailed scope of data contained in tax returns and records in the field of tax on goods and services.

GTU_02 : – Delivery of goods referred to in § 10 section 3 point 1 letter b of the regulation on the detailed scope of data included in tax returns and records in the field of tax on goods and services

GTU_03 : – Delivery of goods referred to in § 10 section 3 point 1 letter c of the regulation on the detailed scope of data included in tax returns and records in the field of tax on goods and services

GTU_04 : – Delivery of goods referred to in § 10 section 3 point 1 letter d of the regulation on the detailed scope of data included in tax returns and records regarding tax on goods and services

GTU_05 : – Delivery of goods referred to in § 10 section 3 point 1 letter e regulation on the detailed scope of data included in tax returns and records in the field of tax on goods and services

GTU_06 : – Delivery of goods referred to in § 10 section 3 point 1 letter f of the regulation on the detailed scope of data included in tax returns and records regarding tax on goods and services

GTU_07 : – Delivery of goods referred to in § 10 section 3 point 1 letter g of the regulation on the detailed scope of data included in tax returns and records in the field of tax on goods and services

GTU_08 : – Delivery of goods referred to in § 10 section 3 point 1 letter h of the regulation on the detailed scope of data included in tax returns and records in the field of tax on goods and services

GTU_09 : – Delivery of goods referred to in § 10 section 3 point 1 letter and regulation on the detailed scope of data included in tax returns and records in the field of tax on goods and services

GTU_10 : – Delivery of goods referred to in § 10 section 3 point 1 letter j of the regulation on the detailed scope of data included in tax returns and records in the field of tax on goods and services

GTU_11 : – Provision of services referred to in § 10 section 3 point 2 letter a of the regulation on the detailed scope of data contained in tax returns and records in the field of tax on goods and services

GTU_12 : – Provision of services referred to in § 10 section 3 point 2 letter b of the regulation on the detailed scope of data included in tax returns and records in the field of tax on goods and services

GTU_13 : – Provision of services referred to in § 10 section 3 point 2 letter c of the regulation on the detailed scope of data included in tax returns and records in the field of tax on goods and services

TStawkaPodatku

Tax rate

value : String

e.g. : – Non-taxable - supplies of goods and services outside the territory of the country

FaWiersz

Class description FaWiersz.

TOznaczenieProcedury

Invoice procedure markings

value : String

WSTO_EE : – Designation regarding the procedure referred to in § 10 section 4 point 2a of the regulation on the detailed scope of data contained in tax returns and records in the field of tax on goods and services

IED : – Designation regarding the procedure referred to in § 10 section 4 point 2b of the regulation on the detailed scope of data contained in tax returns and records in the field of tax on goods and services

TT_D : – Designation regarding the procedure referred to in § 10 section 4 point 5 of the regulation on the detailed scope of data contained in tax returns and records in the field of tax on goods and services

I_42 : – meaning regarding the procedure referred to in § 10 section 4 point 8 of the regulation on the detailed scope of data contained in tax returns and records in the field of tax on goods and services

I_63 : – Designation regarding the procedure referred to in § 10 section 4 point 9 of the regulation on the detailed scope of data contained in tax returns and records in the field of tax on goods and services

B_SPV : – Designation regarding the procedure referred to in § 10 section 4 point 10 of the regulation on the detailed scope of data contained in tax returns and records in the field of tax on goods and services

B_SPV_DOSTAWA : – Designation regarding the procedure referred to in § 10 section 4 point 11 of the regulation on the detailed scope of data contained in tax returns and records in the field of tax on goods and services.

B_MPV_PROWIZJA : – Designation regarding the procedure referred to in § 10 section 4 point 12 of the regulation on the detailed scope of data contained in tax returns and records in the field of tax on goods and services

Reckoning

Diagram: Settlement

Rozliczenie

Class description Reckoning.

Obciazenia

Loads

kwota : Double – Amount added to the amount shown in the field P_15.

powod : String – Reason for the load.

Odliczenia

Deductions.

kwota : Double – Amount deducted from the amount shown in the field P_15.

powod : String – Reason for deduction.

payment

Diagram: Payment

Platnosc

Class description Payment.

ZaplataCzesciowa

Partial payment details.

kwotaZaplatyCzesciowej : Double – Partial payment amount.

dataZaplatyCzesciowej : Date – Date of partial payment, if a partial payment has been made before the invoice is issued

TerminPlatnosci

Date of payment.

termin : Date – Date specifying the payment deadline.

terminOpis : TermDescription – Description of the payment deadline.

TTerminOpis

Ilosc : int – Quantity (the first element of the payment due date description). Specify the number of days, e.g., by which the invoice due date is calculated (e.g., "14").

Jednostka : TZnakowy50 – Time unit (the second element of the payment due date description). Provides the time unit in which the invoice payment due date is calculated (e.g. day, week, etc.).

ZdarzeniePoczatkowe : Character – Starting event (third element of the payment due date description). Specify the starting event from which the invoice payment due date is calculated (e.g., invoice issuance).

TRachunekBankowy

Account information

nrRB : String – Full account number.

The attribute value is verified with a regular expression: [0-9A-Z]{10,32}

The attribute value is verified with a regular expression:

[AZ]{6}[A-Z0-9]{2}([A-Z0-9]{3}){0,1} (Requirement: [0..1])

rachunekWlasnyBanku : Integer – Bank's own account.

The attribute value must match TRachunekWlasnyBanku. (Requirement: [0..1])

nazwaBanku : String – Bank name. (Requirement: [0..1])

opisRachunku : String – Account description (Due: [0..1])

Skonto

Discount

warunkiSkonta : String – Conditions that the buyer should meet to benefit from the discount.

wysokoscSkonta : String – Discount amount.

TFormaPlatnosci

Types of payment methods

TRachunekWlasnyBanku

Types of own accounts

1 : integer – A bank account or an account of a cooperative savings and credit union used to make settlements in respect of monetary receivables purchased by this bank or this union.

2 : integer – A bank account or an account of a cooperative savings and credit union used by the bank or the union to collect receivables from the buyer of goods or the recipient of services for the supply of goods or the provision of services, confirmed by an invoice, and transfer it in whole or in part to the supplier of goods or services.

3 : integer – A bank account or an account of a cooperative savings and credit union operated by this bank or this union as part of its own management, which is not a settlement account.

Transaction Terms

Diagram: Transaction Terms

Diagram: Transaction Terms

WarunkiTransakcji

Class description Transaction Terms.

Umowy

Data describing the contract.

dataUmowy : Date – Date of conclusion of the contract. (Requirement: [0..1])

nrUmowy : String – Agreement number. (Requirement: [0..1])

Zamowienia

Orders

dataZamowienia : Date – Order date. (Requirement: [0..1])

nrZamowienia : String – Order number. (Requirement: [0..1])

Transport

Transport

rodzajTransportu : Integer – Type of transport used in the case of delivery of goods.

The attribute value must match TRodzajTransportu.

transportInny : Integer – Tag of another type of transport: 1 – other type of transport

opisInnegoTransportu : String – Description of another type of transport

przewoznik : Carrier – Data describing the carrier performing the transport.

The attribute value must match Carrier. (Requirement: [0..1])

nrZleceniaTransportu : String – Transport order number. (Requirement: [0..1])

opisLadunku : Integer – Description of the payload type.

The attribute value must match TLoad.

ladunekInny : Integer – Other payload tag: 1 – other payload.

opisInnegoLadunku : String – Description of another load, including mixed load.

jednostkaOpakowania : String – Packaging unit. (Requirement: [0..1])

dataGodzRozpTransportu : DateTime – Date and time of start of transport. (Requirement: [0..1])

dataGodzZakTransportu : DateTime – Date and time when the transport ended. (Requirement: [0..1])

wysylkaZ : TAdres – Shipping address.

The attribute value must match TAddress. (Requirement: [0..1])

wysylkaPrzez : TAddress – Intermediate shipping address.

The attribute value must match TAddress. (Requirement: [0..20])

wysylkaDo : TAddress – Address of the destination to which the transport was ordered.

The attribute value must match TAddress. (Requirement: [0..1])

Przewoznik

The carrier carrying out the transport.

daneIdentyfikacyjne : TPodmotyw2 – Carrier identification data.

The attribute value must match TPodmiot2.

adresPrzewoznika : TAdres – Carrier's address.

The attribute value must match TAddress.

TRodzajTransportu

Transport type

7 : Integer – Fixed transmission installations

8 : Integer – Inland navigation

TLadunek

Load types

15 : Integer – Container for solid bulk cargo

16 : Integer – Container for bulk cargo in liquid form

Order

Diagram: Order

Diagram: Order

TGTU

Description of the enumeration TGTU.

TStawkaPodatku

Description of the enumeration TStawkaPodatku.

Zamowienie

The order or agreement referred to in Art. 106f section 1 point 4 of the Act (for advance invoices) in the currency in which the advance invoice was issued. In the case of an invoice correcting an advance payment invoice, differences resulting from the correction of individual items of the order or contract or data of corrected items before and after the correction should be shown as separate lines if the correction concerns the value of the order or contract. In the case of invoices correcting advance payment invoices, if the correction does not concern the value of the order or contract and at the same time changes the amount of the tax base or tax, an entry should be made as before the correction and an entry after the correction in order to confirm that there is no change in the value of a given item.

wartoscZamowienia : Double – Value of the order or contract including the amount of tax.

zamowienieWiersz : OrderWiersz – Detailed items of the order or contract in the currency in which the advance payment invoice was issued.

The attribute value must match OrderPoem. = new ArrayList<>() (Requirement: [1..10000])

ZamowienieWiersz

Detailed items of the order or contract in the currency in which the advance payment invoice was issued.

nrWierszaZam : Integer – Sequential number of the order or contract line.

UU_IDZ : String – Universal unique order or contract line number (Requirement: [0..1])

P_7Z : String – Name (type) of the product or service. (Requirement: [0..1])

indeksZ : String – Field intended for entering the internal code of the product or service assigned by the taxpayer or an additional description. (Requirement: [0..1])

GTINZ : String – Global trade item number. (Requirement: [0..1])

PKWiUZ : String – Symbol of the Polish Classification of Products and Services. (Requirement: [0..1])

CNZ : String – Symbol of the Combined Nomenclature. (Requirement: [0..1])

PKOBZ : String – Symbol of the Polish Classification of Building Objects. (Requirement: [0..1])

P_8AZ : String – Measure of the ordered goods or scope of service. (Requirement: [0..1])

P_8BZ : Double – Quantity of ordered goods or scope of service. (Requirement: [0..1])

P_9AZ : Double – Net unit price.

p11NettoZ : Double – Value of the ordered goods or services without the amount of tax. (Requirement: [0..1])

p11VatZ : Double – Amount of tax on the ordered goods or services. (Requirement: [0..1])

P_12Z : TStawkaPodatku – Tax rate.

The attribute value must match TStawkaPodatku. (Requirement: [0..1])

P_12Z_XII : Double – Value added tax rate in the case referred to in Section XII, Chapter 6a of the Act. (Requirement: [0..1])

p12ZZal15 : Integer – Tag for the product or service listed in Annex 15 to the Act – value "1". (Requirement: [0..1])

GTUZ : TGTU – Designation for the supply of goods and services.

The attribute value must match TGTU. (Requirement: [0..1])

proceduraZ : TOproceduressignificationZ – Procedure markings.

The attribute value must match TOmeaningProceduresZ.

kwotaAkcyzyZ : Double – The amount of excise duty included in the price of the goods. (Requirement: [0..1])

stanPrzedZ : Integer – Status marker before correction in the case of an invoice correcting an invoice documenting the receipt of payment or part thereof before performing an action and an invoice issued in connection with Art. 106f section 4 of the Act, if the correction concerns data shown in the order items and is made in a way that involves showing the data before and after the correction as separate lines with separate numbering and in the case of confirming the lack of change in the value of a given item. (Requirement: [0..1])

TOznaczenieProceduryZ

Procurement markings.

value : String

WSTO_EE : – Designation regarding the procedure referred to in § 10 section 4 point 2a of the regulation on the detailed scope of data included in tax returns and records in the field of tax on goods and services.

IED : – Designation regarding the procedure referred to in § 10 section 4 point 2b of the regulation on the detailed scope of data contained in tax returns and records in the field of tax on goods and services.

TT_D : – Designation regarding the procedure referred to in § 10 section 4 point 5 of the regulation on the detailed scope of data included in tax returns and records in the field of tax on goods and services.

B_SPV : – Designation regarding the procedure referred to in § 10 section 4 point 10 of the regulation on the detailed scope of data contained in tax returns and records in the field of tax on goods and services.

B_SPV_DOSTAWA : – Designation regarding the procedure referred to in § 10 section 4 point 11 of the regulation on the detailed scope of data contained in tax returns and records in the field of tax on goods and services.

B_MPV_PROWIZJA : – Designation regarding the procedure referred to in § 10 section 4 point 12 of the regulation on the detailed scope of data contained in tax returns and records in the field of tax on goods and services.

Common

Address

Diagram: Address

Diagram: Address

Podmiot1

Class description Entity1.

Podmiot2

Class description Entity2.

Podmiot3

Class description Entity3.

PodmiotUpowazniony

Class description Authorized Entity.

Podmiot1K

In case of correction of the seller's data, please provide the full details of the seller appearing on the corrected invoice. The field does not apply to the correction of an incorrect NIP number appearing on the original invoice - then the invoice must be corrected to zero values.

prefiksPodatnika : TKodyKrajowUE – Code (prefix) of the EU VAT payer for the cases specified in Art. 97 section 10 points 2 and 3 of the Act and in the case referred to in Art. 136 section 1 point 3 of the Act.

daneIdentyfikacyjne : TPodmotyw1 – Taxpayer identification data.

The attribute value must match Entity1.

adres : TAdres – Taxpayer's address.

The attribute value must match TAddress.

Podmiot2K

In the event of correction of the data of the buyer acting as Entity2 or an additional buyer acting as Entity3, please provide the full details of this entity appearing on the corrected invoice. Incorrect numbers identifying the buyer and additional buyer are not subject to correction. In the case of correcting the remaining data of the buyer or additional buyer, the indicated identification number should be identical to the number in the Entity2 or Entity3 part of the correction invoice.

daneIdentyfikacyjne : TPodmotyw2 – Data identifying the buyer.

The attribute value must match Entity2.

adres : TAdres – Buyer's address. Optional fields for cases specified in Art. 106e section 5 point 3 of the Act.

The attribute value must match TAddress. (Requirement: [0..1])

idNabywcy : String – Unique key for linking the buyer's data on correction invoices, in case the buyer's data on the correction invoice has changed in relation to the data on the corrected invoice. (Requirement: [0..1])

Transport

Class description Transport.

Przewoznik

Class description Carrier.

TAdres

Information describing the address

kodKraju : TKodKraju – Country Code. The attribute value must match TKodKraju.

adresL1 : String – Address [Address] – first line of the address. Max 512 characters

adresL2 : String – Address [Address] – second line of the address. Max 512 characters (Requirement: [0..1])

GLN : String – Global Location Number [Global Location Number] (Requirement: [0..1])

Identification of

Diagram: Identification Data

Diagram: Identification Data

Podmiot1

Class description Entity1.

Podmiot2

Class description Entity2.

Podmiot3

Class description Entity3.

PodmiotUpowazniony

Class description Authorized Entity.

TPodmiot1

A set of taxpayer identification data.

NIP : String – Tax identification number NIP

nazwa : String – Name and surname or name of the taxpayer. Max 512 characters

TPodmiot2

A set of identification data and address details of the buyer.

Attention! Must be completed only one of 4 possible identifiers:

- Tax Identification Number, or

- EU code and VAT No. EU, or

- country code and ID no, or

- missingID

The selected identifier is the number by which the purchaser of the goods or services is identified for the tax or value added tax under which he received the goods or services, subject to Article 106e section 1 point 24 letter b of the Act. Optional field for the case specified in Art. 106e section 5 point 2 of the Act. In the case of invoices issued under the simplified procedure by the second largest taxpayer referred to in Art. 135 section 1 point 4 letter bic and mouth 2 of the Act, the number referred to in Art. 136 section 1 point 4 of the Act.

NIP : String – Tax identification number NIP.

The attribute value is verified according to the regular expression: [1-9]((\d[1-9])|([1-9]\d))\d{7} (Requirement: [0..1])

kodUE : TKodyKrajowUE – Code (prefix) of the EU VAT buyer referred to in Art. 106e section 1 point 24 of the Act and in the case referred to in Art. 136 section 1 point 4 of the Act.

By default, this is the Polish feeder code, i.e. "PL". The attribute value must match TKodesNationalEU.

(Requirement: [0..1])

nrVatUE : String – VAT identification number of the EU contractor. (Requirement: [0..1])

kodKraju : TKodKraju – Code of the country of issuing the tax ID. The attribute value must match TKodKraju. (Requirement: [0..1])

The attribute value is verified according to the regular expression: [a-zA-Z0-9]{1,50} (Requirement: [0..1])

brakID : Integer – The entity does not have a tax identifier or the identifier does not appear on the invoice: 1- yes (Requirement: [0..1])

nazwa : String – Optional data for the cases referred to in art. 106e section 5 point 3 of the Act. Name and surname or name. (Requirement: [0..1])

TPodmiot3

A set of identification data and address data of third parties.

Attention! Must be completed only one of 5 possible identifiers:

- Tax Identification Number, or

- idInt, or

- EU code and VAT No. EU, or

- country code and ID no, or

- missingID

The selected identifier is the number by which the purchaser of the goods or services is identified for the tax or value added tax under which he received the goods or services, subject to Article 106e section 1 point 24 letter b of the Act. Optional field for the case specified in Art. 106e section 5 point 2 of the Act. In the case of invoices issued under the simplified procedure by the second largest taxpayer referred to in Art. 135 section 1 point 4 letter bic and mouth 2 of the Act, the number referred to in Art. 136 section 1 point 4 of the Act

NIP : String – Tax identification number NIP.

The attribute value is validated according to the regular expression: [1-9]((\d[1-9])|([1-9]\d))\d{7}

idWew : String – Internal identifier with Tax Identification Number.